Why wealth has less to do with income and everything to do with discipline

There’s a myth floating around that you need a six-figure salary to retire with seven figures. It’s false. Real wealth isn’t built on massive paychecks — it’s built on consistency, discipline, and refusing to fall for money sabotage traps.

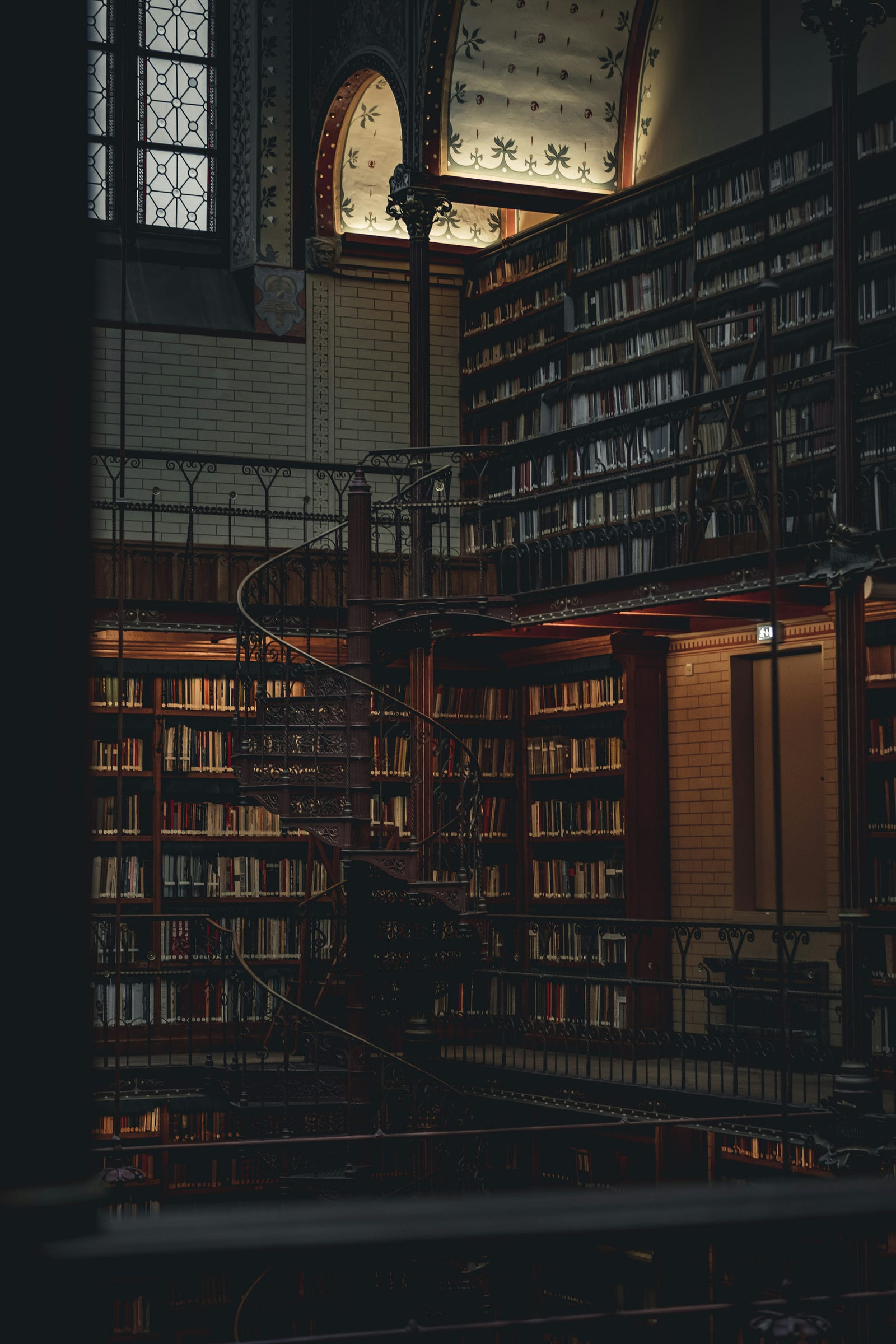

Take the story of a librarian who retired a millionaire while never earning more than $48,000 a year. No lottery wins. No secret inheritance. Just three simple habits executed with relentless commitment.

Wealth is less about how much you make and more about how much you keep. If you can resist the noise of consumer culture, live below your means, and prioritize the right actions, seven figures is not only possible — it’s predictable.

So, what were the three secrets?

1. Save Hard

Saving is the foundation. Anyone can spend, but few have the grit to consistently save.

- Live below your means — way below.

- Skip the luxuries that only signal wealth but don’t create it.

- Make saving a rule, not an afterthought.

Every dollar you don’t spend becomes a worker for your future. Saving hard isn’t glamorous, but it’s how ordinary earners separate themselves from the crowd. While most chase appearances, savers chase freedom.

2. Invest Wisely

Every millionaire story eventually comes back to investing. Saving builds the base, but investing multiplies it.

What does “investing wisely” look like?

- Invest early: The earlier you start, the harder compounding works for you.

- Invest consistently: Breaks kill momentum. Wealth comes from investing through highs, lows, and boredom.

- Invest thoughtfully: Study before you put money in. Understand the risk, the asset, and the long-term trajectory.

Money sabotage happens when people gamble blindly, chase hype, or stop investing the moment life gets “busy.” Consistency and patience are the weapons that turn modest salaries into million-dollar nest eggs.

3. Stay Healthy

This one surprises people — but health is wealth. You can stack millions, but if you’re too sick to enjoy it (or too burdened with medical bills), what’s the point?

Building health requires the same discipline as building wealth:

- Clean diet → Energy and longevity.

- Regular exercise → Strength and resilience.

- Quality sleep → Recovery and focus.

By taking care of your body, you don’t just live longer — you also lower stress, reduce medical costs, and protect the very machine that generates your income. Ignoring health is financial sabotage in disguise.

The Overlooked Truth

Millionaires aren’t only born from tech salaries or Wall Street bonuses. They’re born from teachers, librarians, and everyday earners who mastered discipline while everyone else was distracted.

Save hard. Invest wisely. Stay healthy. These aren’t glamorous secrets. They’re simple. But simple, repeated long enough, becomes extraordinary.

Wealth isn’t about luck or income. It’s about habits you repeat until they become unstoppable.

Financial Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research and consult with a licensed financial advisor before making investment and financial decisions.